If you had to, could you add $5,000 or $6,000, or more, to your regular monthly expenses, without depleting your savings?

Elder Law

what is it?

Are you concerned about how you would pay for the cost of institutional long-term care? Wondering if you should be concerned?

The cost of assisted living or nursing care is rising rapidly. The average cost of a room in the Fort Worth - Dallas area ranges from $5,000 to $7,500 per month. Memory care facilities are significantly more expensive.

Do you believe nursing care will never be necessary for you? The statistics may surprise you. At the very least, they should prompt you to consider the issue more carefully before you dismiss it. Here they are:

Seventy-percent (70%) of Americans over 65 will need long-term care in the future. That is SEVEN in TEN retirement-age seniors.

Payment Options

Self-Pay

Paying for assisted living out-of-pocket is certainly an option, even if it depletes or exhausts your life savings. If it is important to you, however, to preserve assets for your children, a healthy spouse, or to add to your own care, check the chart below to see the liquid assets it takes to generate, $5,000, $6,000, or $8,000 per month to cover nursing care.

Long-Term Care Insurance

If you have it or can qualify, life insurance that allows acceleration of the death benefit to cover long-term care costs is the second option.

Medicaid

If you don’t have $2 million in liquid assets you can invest to generate the amount of income it takes to self-pay, elder law planning may make all the difference for you. Whether you have time to proactively plan or a loved one is about to be placed in a nursing home, we can help you plan to shelter assets that would otherwise disqualify a person from receiving Medicaid benefits.

Keep reading to learn more about asset protection planning with Medicaid in mind.

The math involved in self-paying for long-term care.

If you think you would self-pay for nursing care, here is a look at how much you need to invest.

$ 2 Million Investment

$72,000

$60,000

$96,000

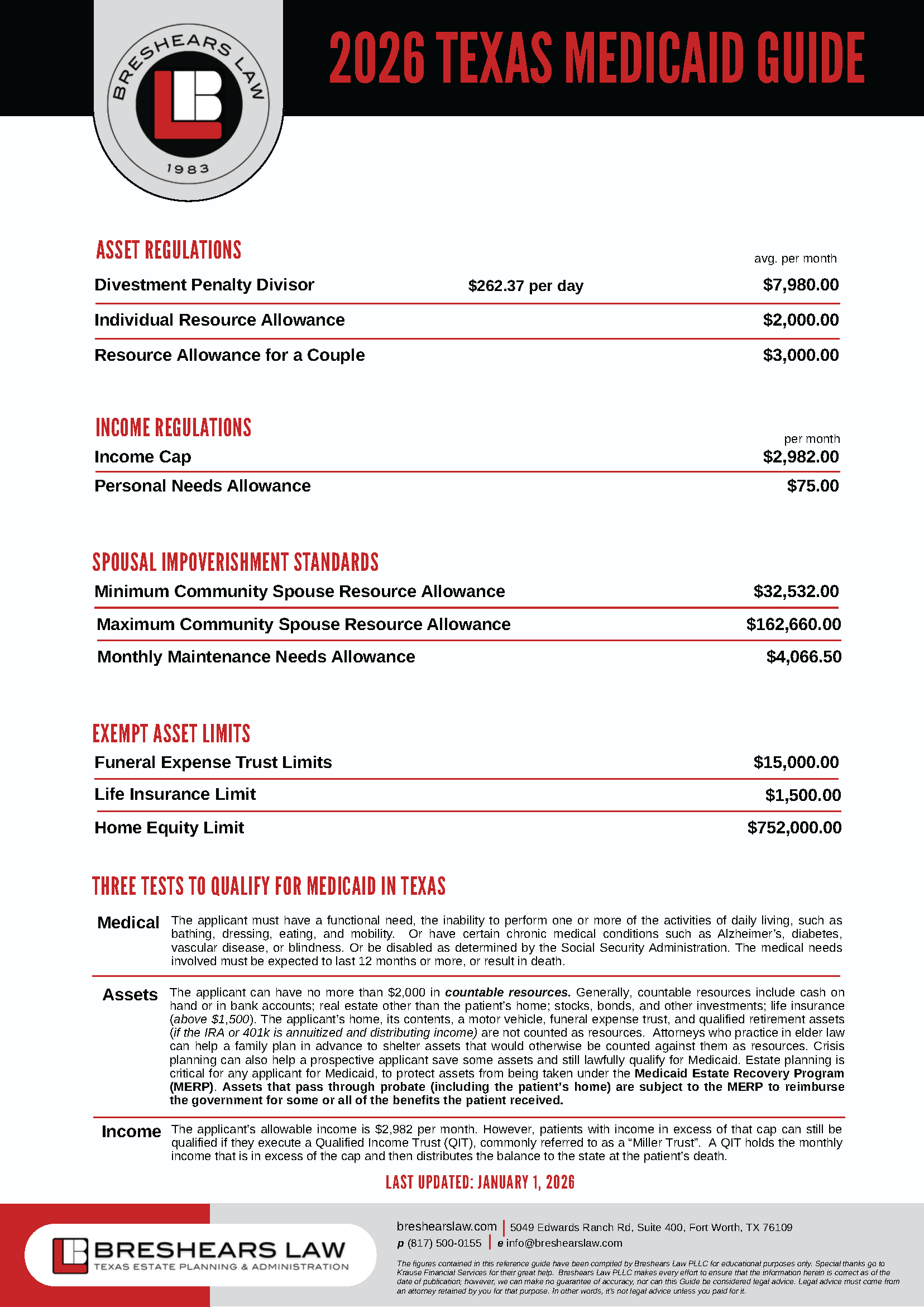

Key Medicaid Rules

Applicants for Medicaid must pass three qualifying tests:

Asset Test.

Income Test.

Medical Necessity.

All other assets are counted toward the $2,000 limit, including:

Excess cash

Stocks, bonds and other investment accounts

Additional real estate

Additional motor vehicles

Life insurance with more than $1,500 in cash surrender value

Income Test

In 2026 the individual monthly income limit for Texas Medicaid is $2,982 .

For applicants that are over the limit, we can prepare a specific trust (called a “Miller Trust” named after the family who first used it successfully) enabling that applicant to qualify under the income test despite being over the income cap.

3.0%

3.6%

4.8%

Asset Test

An applicant for Medicaid can have only $2,000 in countable resources. The key is the word “countable”. Not all assets are counted toward the $2,000 limit. Examples of those exempt assets include:

Your primary residence. The equity in your primary home is not a countable resource, up to a maximum of $752,000 in 2026.

Contents of your home.

Your primary vehicle.

Retirement accounts that are actively distributing income.

Clothing, wedding rings, and other personal effects.

Irrevocable funeral home trusts.

Income-producing real estate.

Certain annuities

Medical Test

The medical necessity required to qualify for Medicaid involves an assessment of the applicant’s ability, or more properly the inability, to perform one or more of the activities of daily living (ADLs): eating, bathing, dressing, toileting, transferring (moving between surfaces like a bed and chair), and personal hygiene.

Memory deficits substitute for the ADLs to qualify the applicant.

Elder Law Planning Cases

Proactive Planning Cases

For clients who recognize early that they may not be able to self-pay for long-term care should they be disabled, we can employ proactive trust planning to shelter assets that would otherwise disqualify you from qualifying for benefits.

Countable resources (like excess cash, investment assets, etc) can be transferred to an irrevocable trust, protecting them immediately from all external threats like lawsuits, divorce, business failure and other unforeseen circumstances. After those assets have been held in an irrevocable Medicaid Asset Protection Trust for a period of five years, those assets will no longer be treated as countable resources. Our client can qualify for Medicaid right away.

Exempt assets like your primary residence are placed in a revocable trust. The trust removes those assets from the probate system and prevents them from being subject to the state’s Medicaid Asset Recovery Program (which impacts only probate assets).

Urgent Planning Cases

In those cases where the applicant’s healthcare needs are going to require placement in a nursing home in the next thirty to sixty days, we can still help shelter a significant percentage of the applicant’s assets.

The options are more limited in urgent cases, but we can use the Medicaid rules to calculate the largest possible gift to a trust that still leaves enough resources in the applicant’s estate to cover the cost of care during the resulting penalty period. In other words, we use the gift to create a penalty period our client can afford.

The cash remaining in the estate is then used to purchase a special Medicaid compliant annuity, which covers the applicant’s cost of care for the duration of the penalty period.

As a result, our client is immediately qualified for Medicaid upon entry into the nursing home.

Let’s work together.

Interested in us as your attorney? Fill out some info and we will be in touch shortly! We can't wait to hear from you!

We’ve been waiting to hear from you for 35 years!