The Three Biggest Estate Planning Mistakes (Part 3) - The Disability Dilemma

In Part 1 of this series we addressed the first big mistake we see, which is the DIY Document. What non-lawyers don’t know about documents they download from the internet can and often does harm their family. In Part 2 we discussed the Asset Problem; failing to own assets in a way that is consistent with the overall objectives of their estate plans.

In the final chapter of this series we address the third big mistake we see in estate planning, The Disability Dilemma; failing to plan for disability during life and the impact of long-term care costs on their resources.

Cost of Long-Term Care

〰️

Cost of Long-Term Care 〰️

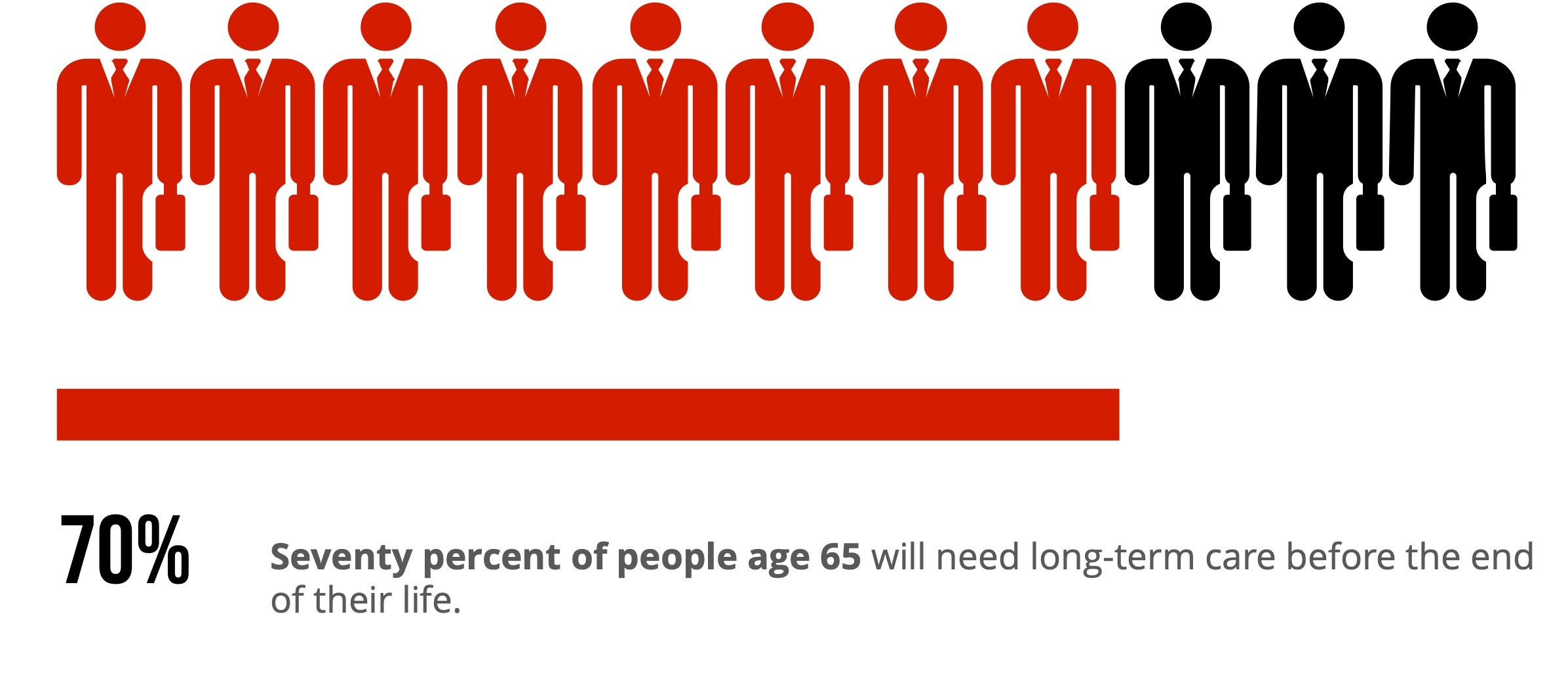

It not only can happen to any one of us, but disability is going to become a reality for seven out of ten individuals 65 years or older. For those who need it, the average annual cost of a private room in a nursing home is $100,000.

There are three ways to pay for longterm care:

Self-Pay. The patient and/or his family can pay the nursing home directly, using their income or resources. For those who lack the income to add $5,000 to $12,000 per month to cover long-term care, they can quickly deplete their life savings.

Insurance. Long-term care insurance policies can be used to defray long-term care costs.

Medicaid. The third payment option is to use Medicaid benefits. Medicaid is a program funded by the federal government to provide benefits to those in need. Medicaid rules are complicated, but with proper planning many Americans can avoid exhausting their life savings and qualify for Medicaid benefits.

Who Needs to Consider Medicaid?

In order to generate enough income to pay the average annual cost of nursing care - $100,000 - a person needs a total of $2.5 million in invested assets that will earn a return of 4% annually. For those who do not have those resources or other income sufficient to pay the additional $100,000 in longterm care costs, Medicaid offers a safety net.

If you or a loved one are among the large majority who do not have the income to absorb the rising costs of long-term care, planning with a firm like ours can help. Click below to learn more, and then call us to schedule a meeting with Joe.

-

To qualify for Medicaid, Texas law provides that the applicant can only have $2,000 in countable resources. At first blush, it seems like only the poorest of the poor can qualify. However, that could scarcely be farther from reality. The limit doesn’t apply to all assets. It applies only to countable assets.

The good news is that some of your most valuable assets do not count against that $2,000 limit. Assets that are exempt from the resource limit include:

Home Equity. The applicant’s home equity, up to a limit ($730,000 in 2025)

Tangible Personal Property. The contents of the applicant’s home

A car

Funeral Trust. A funeral expense trust up to $15,000

IRAs. In most cases, the applicant’s Individual Retirement Account(s). IRAs that are in payout status are considered income, not assets.

Consider the case of our clients, George and Betty Wilson, both age 68. Their assets consisted of:

A home worth $375,000 and contents estimated at $55,000

A couple of rent houses worth a total of $535,000

Bank accounts with a total value of $95,000

An investment account worth $125,000

An IRA from George’s career worth $1,200,000

Betty’s pension from the Teacher Retirement System

Each of them had a car that was paid for

George and Betty were thrilled to learn that their home, its contents, George’s IRA, Betty’s pension, and their cars were all exempt from being counted as resources. A total of $1.63 million dollars in assets (plus their cars) were already exempt from being considered countable resources.

That left only $753,000 in assets (cash, stocks, and rental properties) that would keep them from being eligible for Medicaid in the event of disability.

Because George and Betty were both in good health, we implemented a plan that included a revocable living trust to hold their exempt assets, and an irrevocable Medicaid asset protection trust to which they could transfer their rental properties, stocks, and some of their cash.

Under Medicaid rules, if neither George or Betty need long-term care for five years from the date we transferred assets into their asset protection trust, we will have protected a total of $2.34 million of the Wilsons’ nest egg; leaving only $43,000 in cash that would need to be spent down for them to be eligible for Medicaid benefits.

Our plan will protect 84% of the Wilsons’ assets.

The Wilsons invested roughly the cost of two months of nursing care - about $11,600 - to save $2,340,000. As Betty put it,

“If I can write a check for $11,600 that is virtually guaranteed to be worth $2,340,000 in 5 years, I would write that check every day!”

-

Assets that would otherwise be counted against the applicant as a resource can be transferred to an irrevocable trust and excluded from the applicant’s estate. Medicaid only looks back five years from the date of the application for transfers of that sort. For a healthy person who transfers wealth more than five years before the need for care arises, proper planning can shield far greater value than most people understand is possible.

The creator of those trusts is entitled to all of the income from these irrevocable trusts.

-

For those people whose income is greater than the maximum allowed under Medicaid rules ($2,901 for an individual, $5,802 per couple), a specialized trust commonly called a “Miller Trust” allows an individual whose income is too high to legally protect a portion of their income from being counted towards Medicaid eligibility while still being able to use the funds for necessary expenses.